6 Strategies to Save on Home Insurance Premiums In Arizona

The past few years have seen an unprecedented surge in devastating climate and weather events in the United States, from wildfires to floods. In 2023 alone, 28 individual weather-related disasters caused at least $1 billion in damages each. These events have led to a significant rise in home insu

Read MoreWhat is difference between a handyperson and a contractor in Arizona?

According to Arizona handyman laws, a handyperson without a license can work on minor repairs, carpentry, or basic home improvements without a building permit. This can include replacing light fixtures, putting up drywall, fixing windows, assembling furniture, and installing doors. In Arizona,

Read More7 Mistakes To Avoid When Hiring A Contractor In Arizona

A recent survey found that over half (52%) of American homeowners plan a renovation project this year. If you're among them, you know that embarking on home improvements can be exciting and daunting. According to the survey, the median renovation budget is around $15,000, so you're probably inves

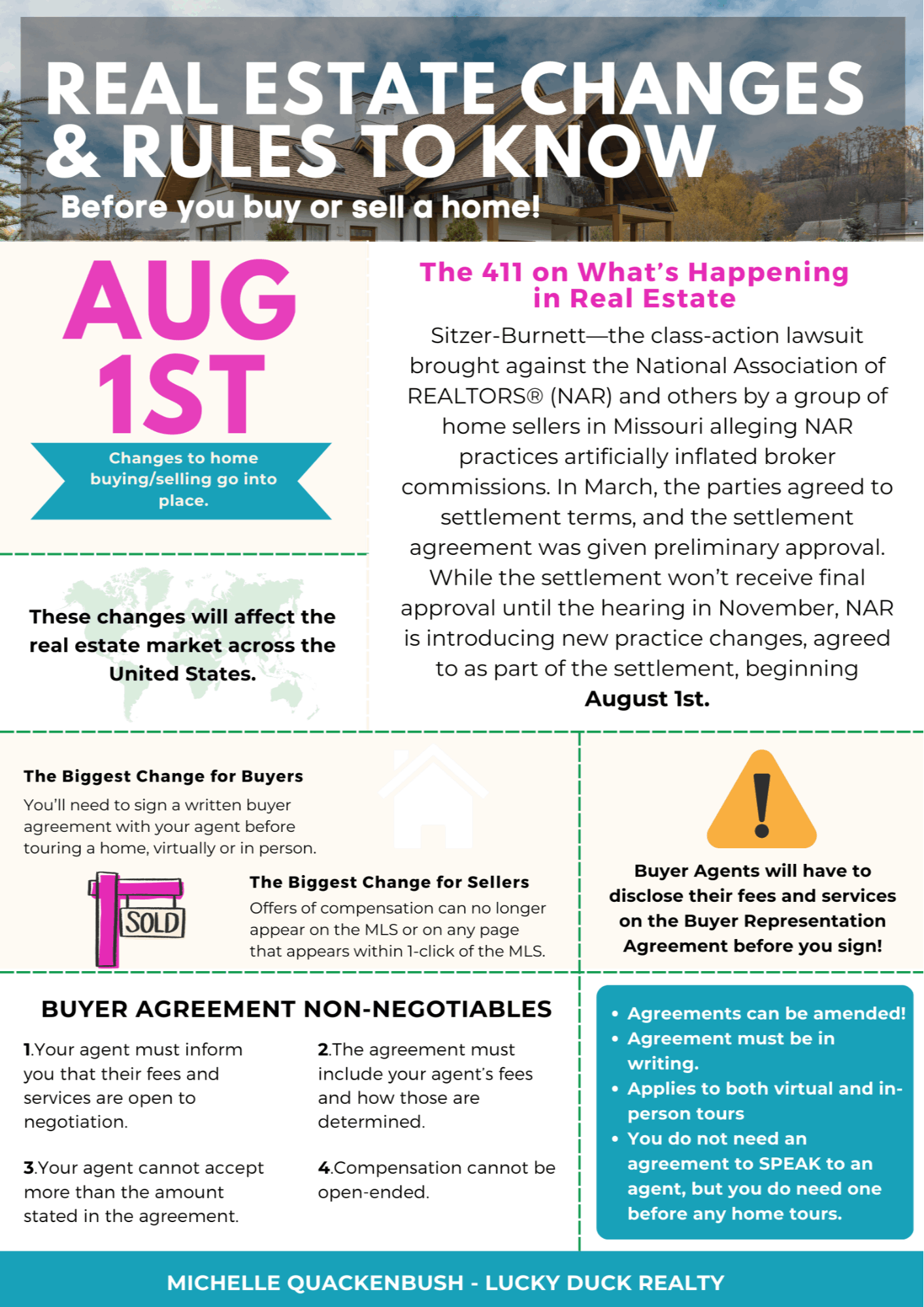

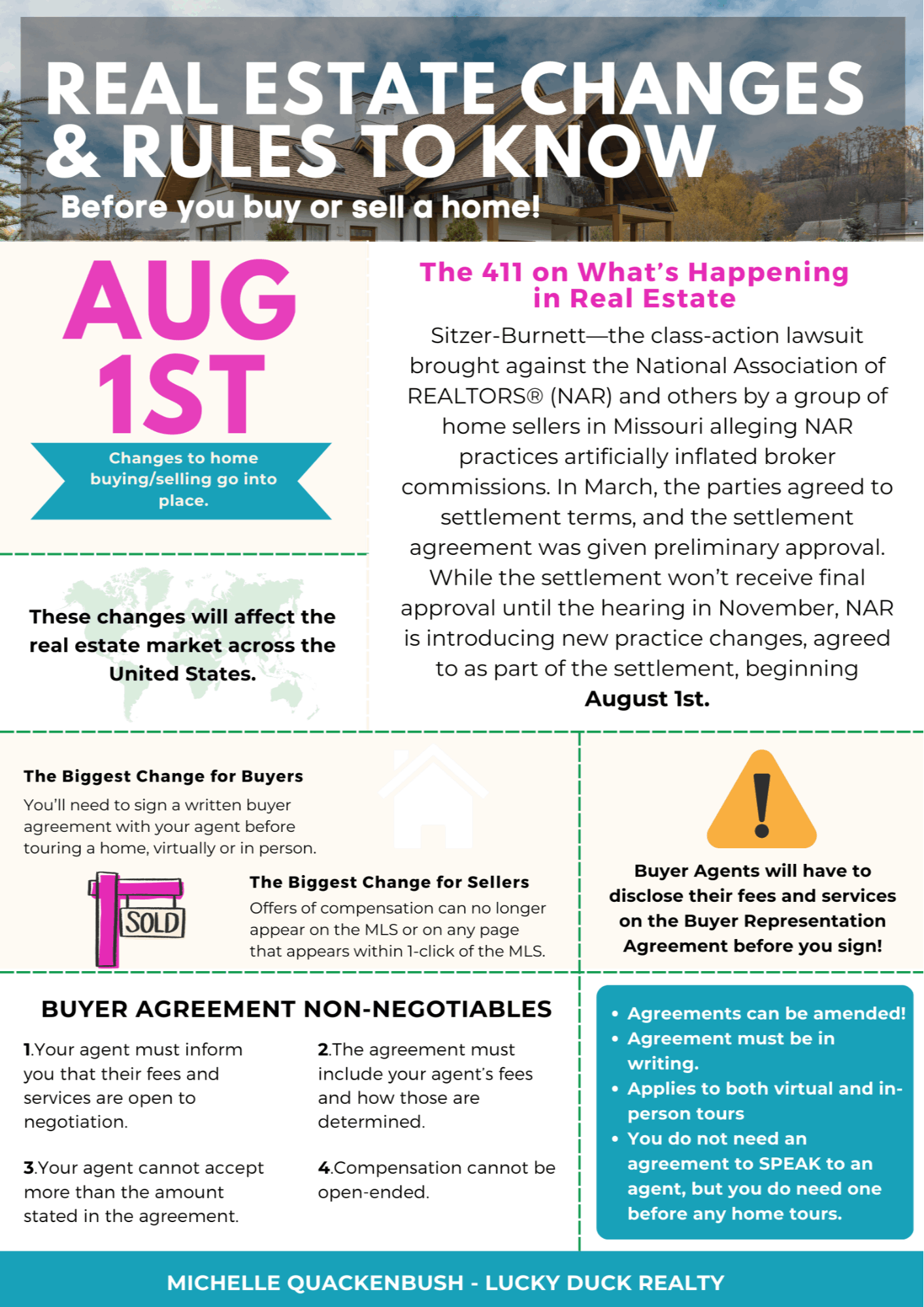

Read MoreWhat Changes A Buyer Can Expect When Buying A Home In Arizona

As of August 1, 2024, real estate across the United States has changed as we know it, and here are the new rules for buyers in the state of Arizona. When buyers are being represented by a Realtor, you must sign a written representation agreement with your Realtor prior to the Realtor showing you a

Read MoreTop 5% of listing agents in Arizona

Congratulations!!!! Michelle Quackenbush of Lucky Duck Realty has received an award for being in the top 5% of listing agents out of 63,000 agents in Arizona. Another essential fact is she has had No expired listings in 2023! If you are looking for a highly experienced agent to sell your property,

Read More2023 Best Public Schools In Phoenix Metro Area

Six valley schools are among the top 100 public high schools in America, according to the 2023 list of highest-ranked public schools from the education data platform Niche. The schools are all Basis charter schools on the list at Best Schools in Phoenix Niche's Phoenix area list. Leading the pack

Read MoreGrant Money For Purchasing a Home In Phoenix Area

Good News For Buyers! Down payment assistance is back! Plus, sellers are offering help with closing costs again! Perfect time to purchase a home. Below are some unique financing options for the Phoenix, Arizona, area. These options are temporary options, once the lenders run out of money the pr

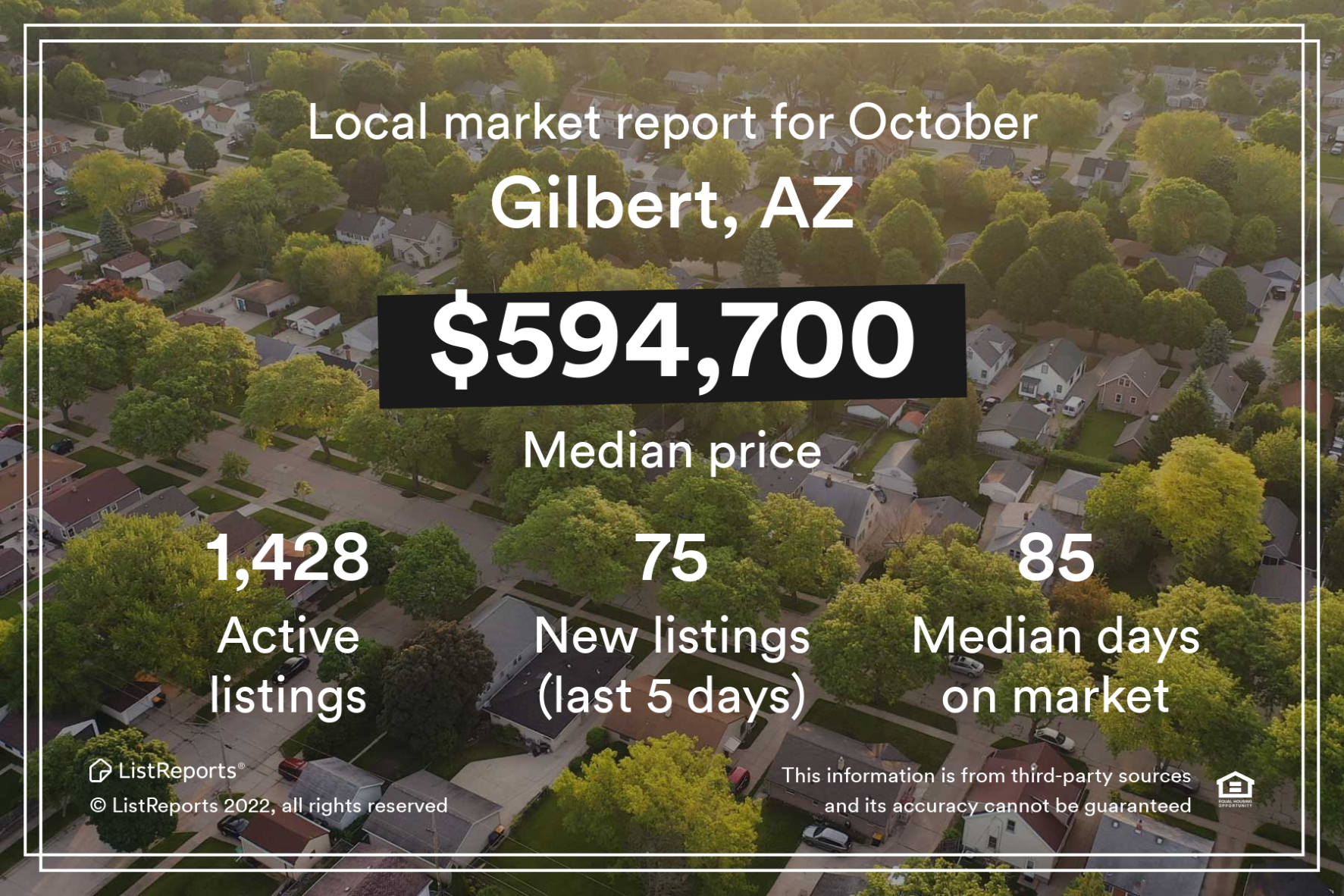

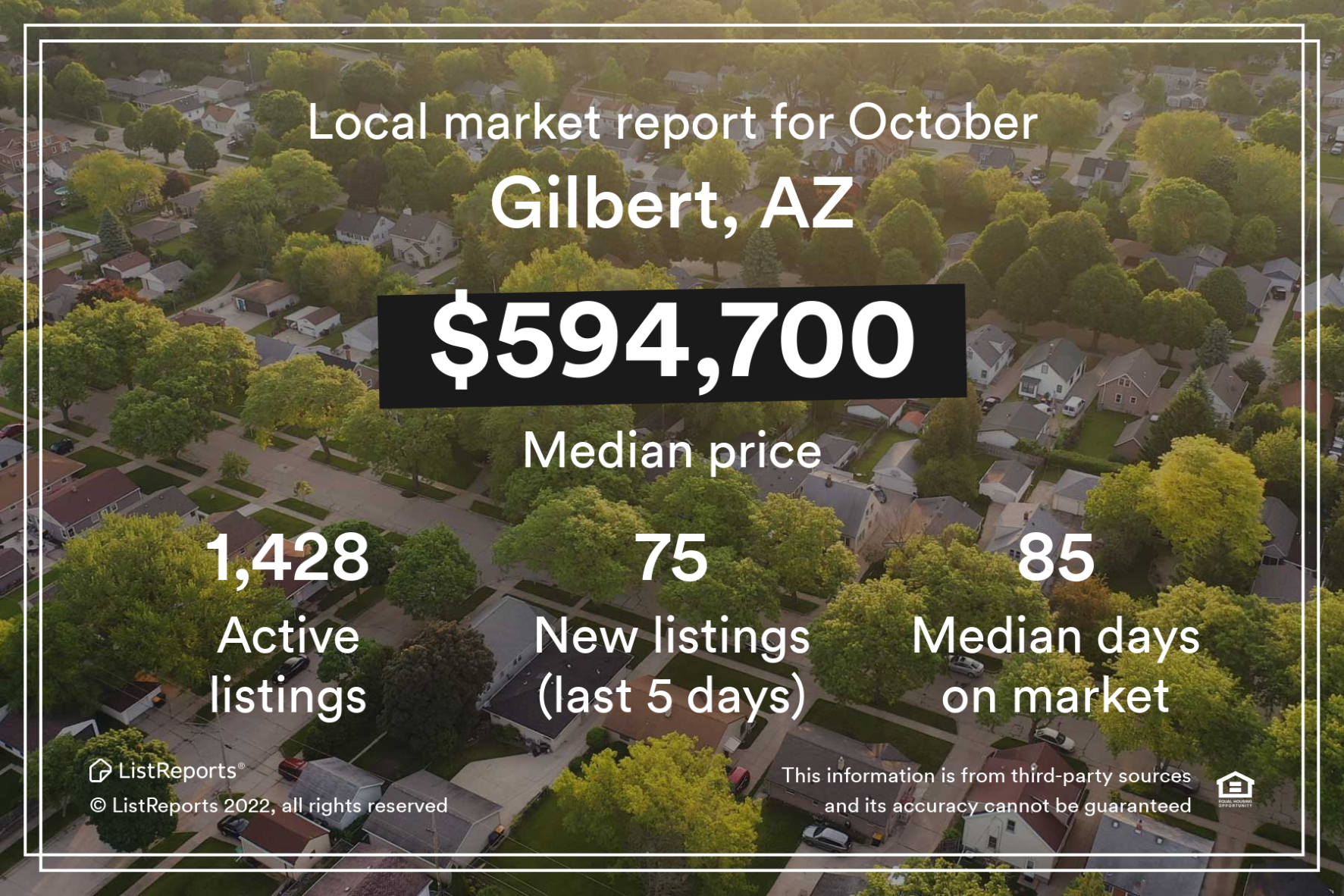

Read MoreGilbert, Arizona Real Estate Market Stats

There are 1428 active properties on the market with an average price of $594,700. The average market days is 85 days, and 273 houses are pending. If you want the value of your home instantly for free, go to https://www.arizonahousesonline.com/evaluation

Read MoreChandler Arizona Real Estate Market Trends

There are 1251 active properties on the market with an average list price of $555,000. The average days on the market is 87. There are 171 pending sales. If you are thinking of selling or would just like to know the value of your home instantly and for free go to https://www.arizonahousesonline.

Read MoreReal Estate Market Trends In Glendale Arizona

The average price range for Glendale, Arizona, is $446,995, with 1152 listings on the market. 202 single-family homes are pending. The average time on the market is 85 days. If you would like the value of your home https://www.arizonahousesonline.com/evaluation

Read MoreLucky Duck Realty is a proud sponsor of The Arizona Pet Project

When you purchase a home or sell one through Lucky Duck Realty and Michelle Quackenbush, I donate to The Arizona Pet Project. The Arizona Pet Project is a nonprofit organization that supports families and saves pets. Their mission is to reduce the number of cats and dogs entering Arizona's shelte

Read MoreTop Private Schools In Phoenix Arizona For 2023

Here is the list of the top 24 private schools in the Phoenix metro area for 2023. The top three are the same top three for 2022. We have included the number of students enrolled, grades taught, teacher-student ratios, and their ratings. Phoenix Country Day School - Paradise Valley has 750 stude

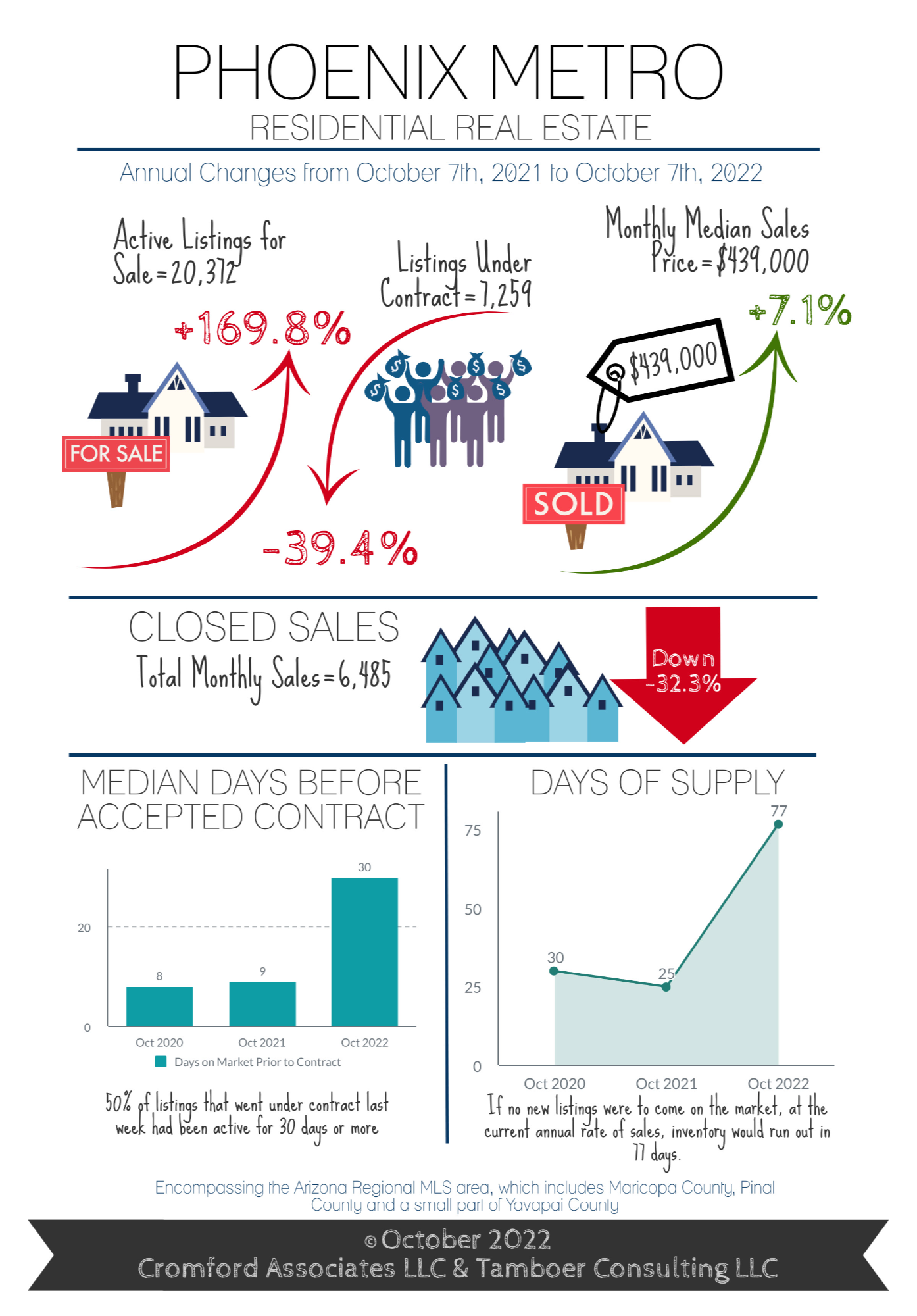

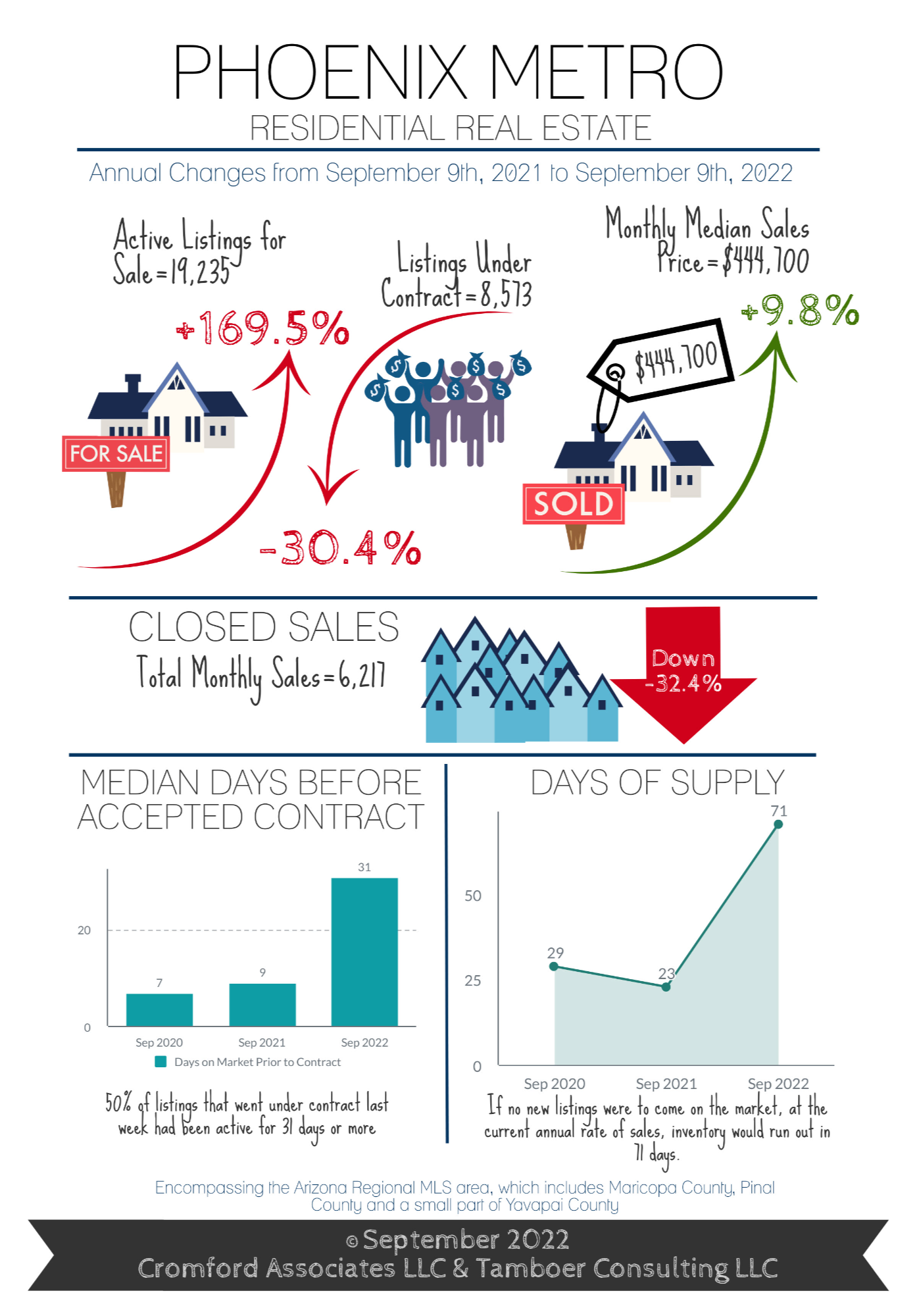

Read MorePhoenix Metro Real Estate Stats

For October 10, 2022 For Sellers: We are coming into our selling season in Oct-May. The best time to sell is before the holidays because most sellers wait until after the holidays, so there is less competition at this time. December has always been a good selling month for me. Most sellers don't l

Read MorePumpkin Patches Around The Valley

Want to visit a pumpkin patch in the Phoenix Metro area? Here is a list! Enjoy.

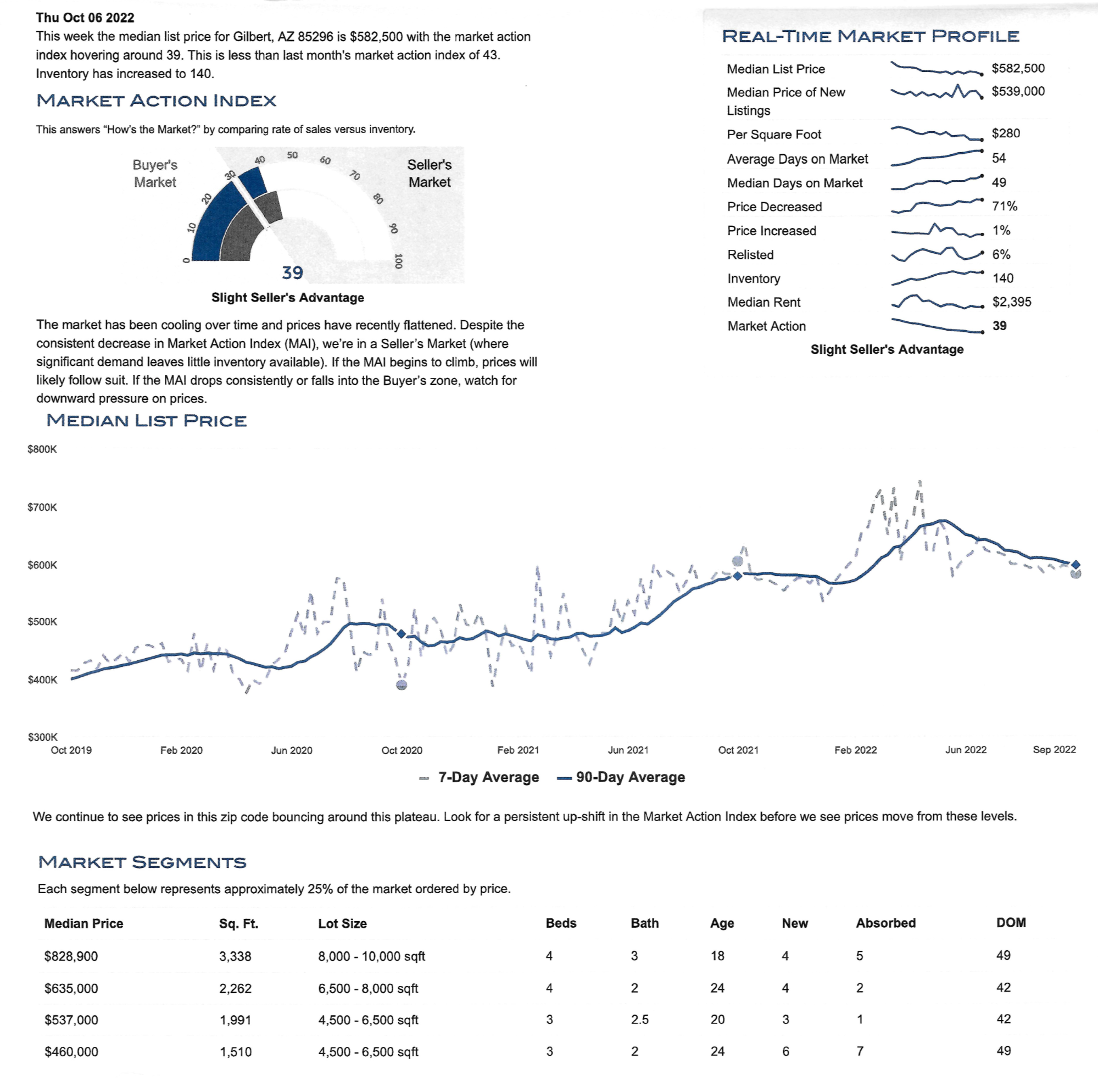

Read MoreGilbert, AZ Real Estate Market Stats for 85296 Zip Code

For Oct 6, 2022 This week the median list price for single-family homes for Gilbert, Arizona, for zip code 85296, is $562,500, with the market action index (MAI) hovering around 30. This is less than last month's market action index of 43. Inventory has increased to 140 homes. The market has been c

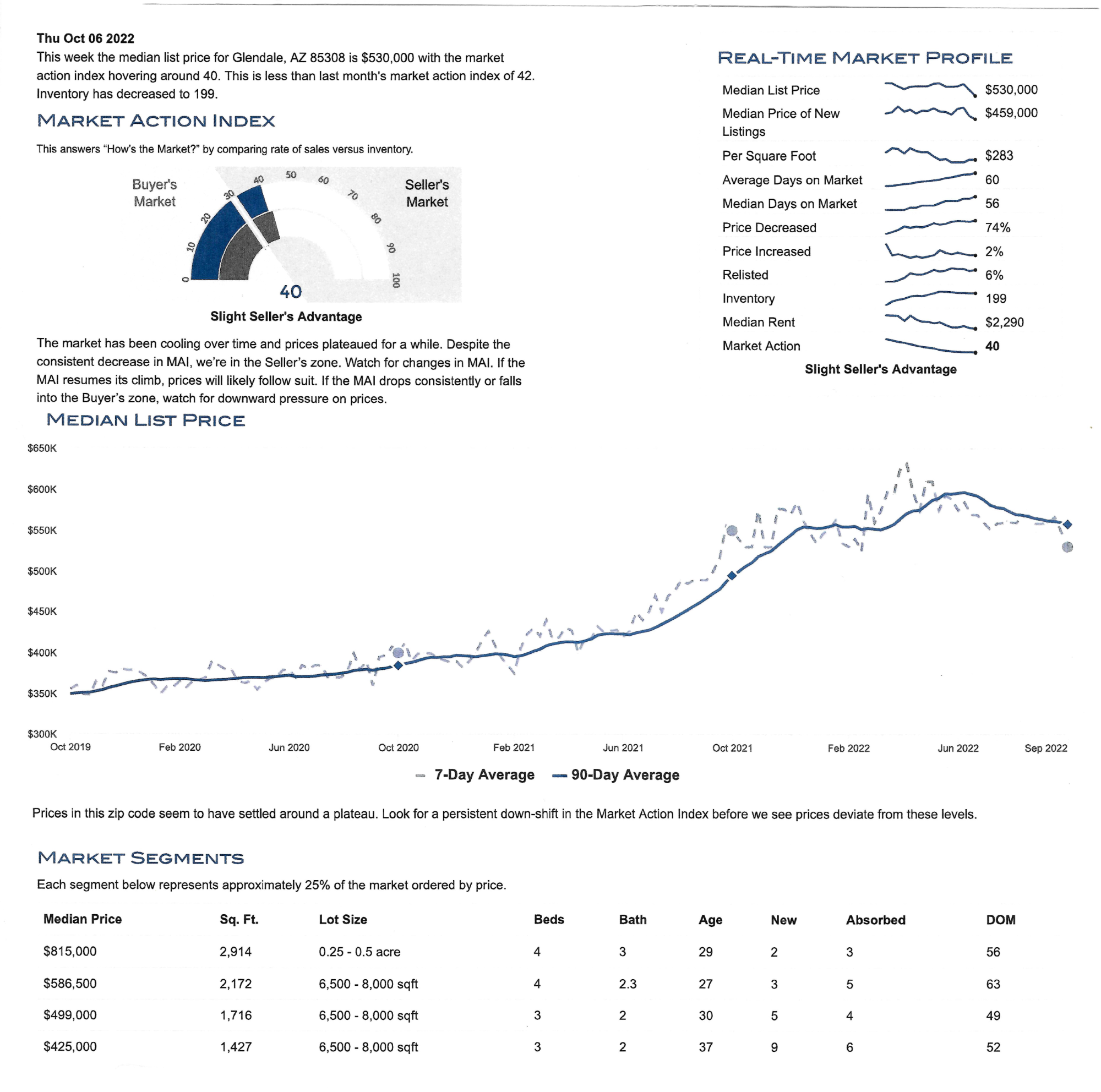

Read MoreGlendale, Arizona Real Estate Market Stats For the 85308 Zip Code

For Oct 6, 2022 The week the median list for a single-family home in Glendale, AZ 85308 is $530,000, with the market action index (MAI) hovering around 40. This is less than last month's action index of 42. Inventory has decreased to 199 homes. The market has been cooling over time, and prices plate

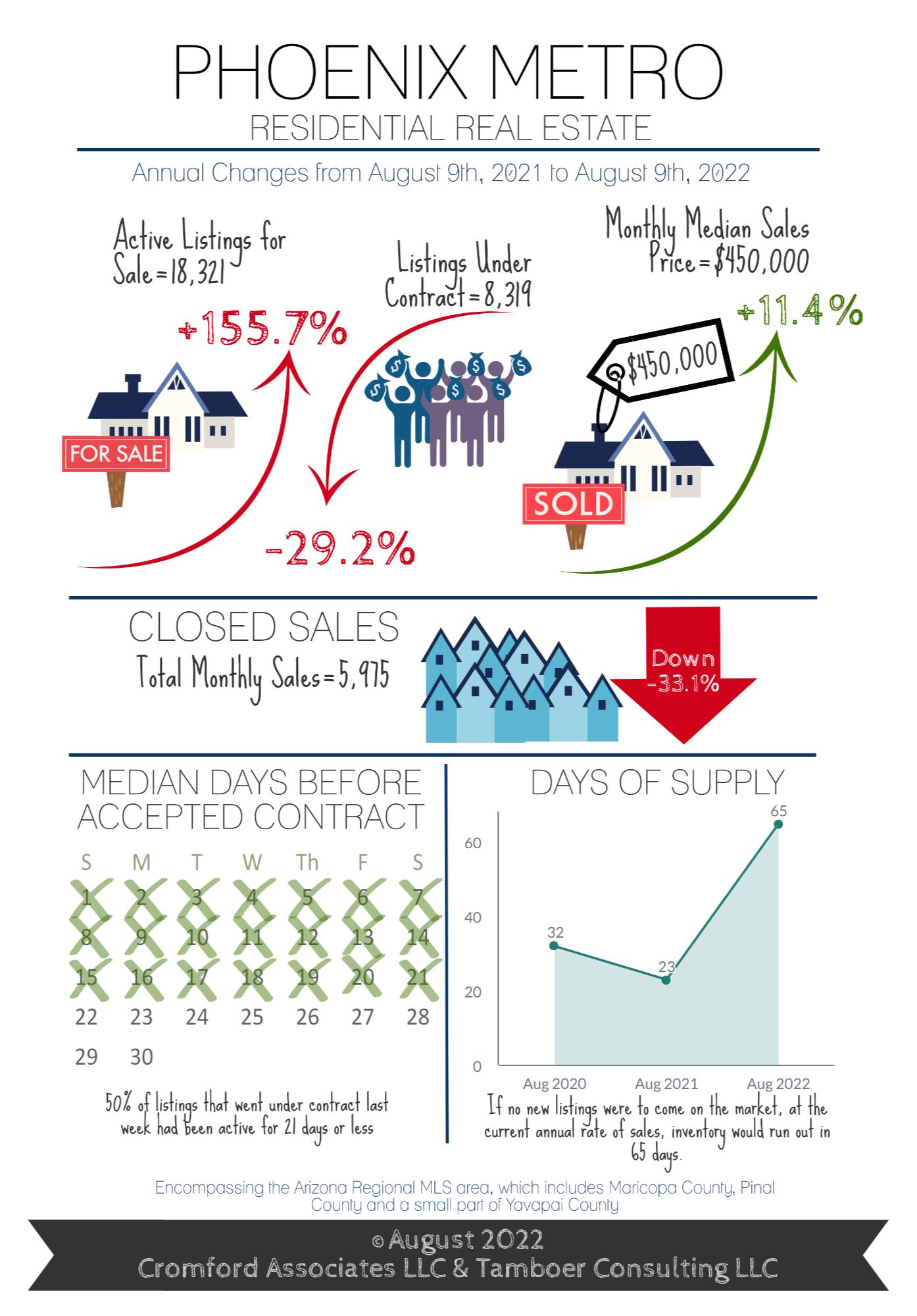

Read MorePhoenix Real Estate Market Stats For August, 2022

For Sellers: The latest spike in interest rates has resulted in a drastic drop in contract activity, down 14% in the last two weeks. Over the last six months, the housing market has shifted from a frenzy to a more balanced market. Until rates drop, sellers need to be realistic about their list price

Read MoreReal Estate Matchmaker-Ready To Fall In Love?

My job is to find you the right home, and your job is to fall in LOVE! Are you ready to fall in love? I am your professional real estate matchmaker. Contact Michelle Quackenbush Lucky Duck Realty 602-999-2627 or LuckyDuckTeam@gmail.com

Read MorePhoenix Housing Stats for July, 2022

Seller Paid Closing Cost Is Back! Sellers are willing to pay for an interest rate buydown or part/all buyer's closing cost. This is good news for buyers. Buyers have more time to decide and more houses to choose from with the average time on the market of 21-65 days. Some properties are still clo

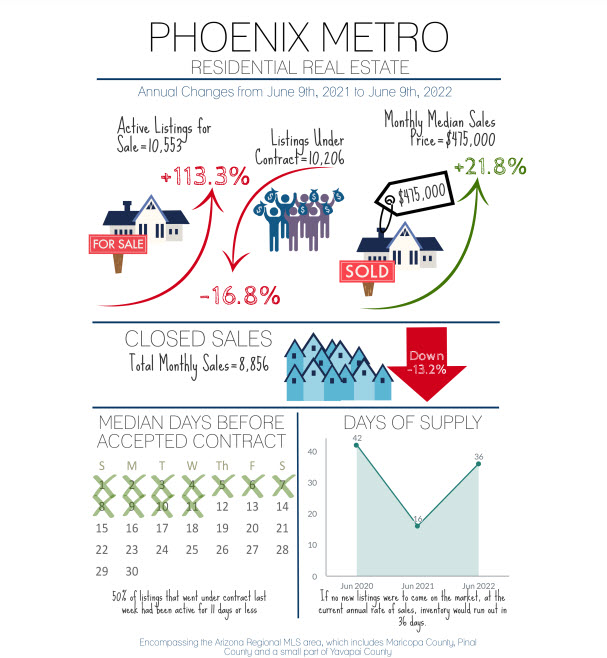

Read MorePhoenix Real Estate Stats for June, 2022

Wondering what is going on in the Phoenix Real Estate Market? These stats are using the data from the MLS System and are for the complete valley. If you are wanting stats for a specific area, please let me know and I would be happy to supply them to you for free.

Read More

Categories

Recent Posts